I am a thirty-five-year-old modern woman. My friends call me a feminist and I accept that I am one. I believe women of this era are intelligent, independent, strong and sensible professionals in several areas, sometimes out beating the men in many diverse fields.

Yes, I am proud to be a woman.

Recently I did a project for a client that focused on women. I interacted with women from different spheres. While having several interesting conversations with all these women, I observed that women’s interest and knowledge in their personal finance is not ideal.

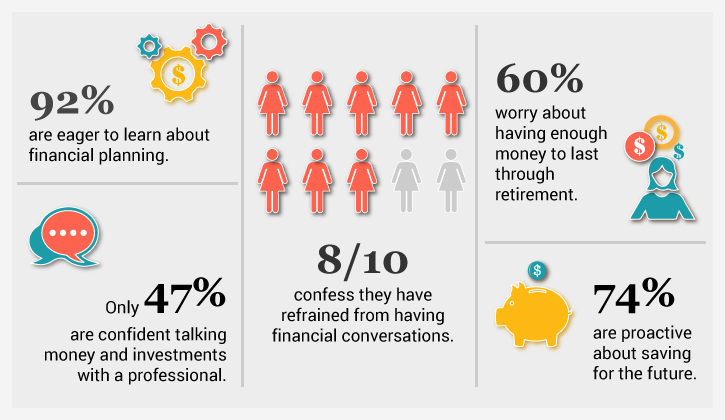

How many women reading this article agree that they have very little interest in financial planning? I have observed that many women irrespective of whether they are breadwinners for their families or are housewives, most of the times depend on their husbands to take all the financial decisions for them and their kids. The reasons could be varied but the point is why do women run from finance when it is the woman who manages all the decisions of the house.

Dear Women – you are a housewife and you are the one who exactly knows the expenditure load of your family.

An incident with a friend recently stirred me to talk about this more openly with my women friends where her husband passed away unexpectedly, very young. Yes, money can’t diminish the emotional trauma and the grief that one goes through when he or she loses a close one but certainly it can make life smoother in these difficult times. Had her husband done good life insurance for himself, she and her kids would be in a better financial status today. These are grave topics and none of us want to talk about it as we don’t usually pre-empt that this could happen to any of us. The topic of losing a spouse and life after that is so stressful that we choose not to discuss. So the easiest thing to do is to stay ignorant.

I would argue that’s precisely why we should talk about it. We should get comfortable with the topic, improve our financial literacy and start taking charge of our financial health so we can handle uncomfortable situations confidently when the need arises.

The reasons why a woman should start learning and understanding and planning her finances are umpteen. Some of them I have listed below.

Reason 1: Life is uncertain and one never knows when a time may come when she has to handle all her financial matters by herself

It is true for most housewives that they have traditionally been left out of financial matters. However, in most cases, women seem to be greatly affected because of a lack of financial planning which she thought the husband would do for her. But what if the husband is no more there? Housewives should start to read, understand take an active interest in these things. It would make her comfortable and confident to handle financial matters just by herself.

Reason 2: Women are the Finance Managers of the family

In most cases, women may take a backseat in earning the bread for their families but isn’t it the woman who runs the family expenses? From grocery to deciding the school and the child’s activities etc., all expenditure of the house is determined and managed by her. If she can run the household so well, she can take an active role in financial planning as well. Women, by nature, are great savers and it is in their blood to save in every situation. They naturally make better financial managers.

Reason 3: Women need to prepare for post-retirement as women are likely to have a longer life span as compared to men

Statistics prove that women usually live longer than men. Therefore, women need to start taking an active interest in planning for their retirement. It is the woman’s responsibility to start thinking about how she can stay financially healthy at the retirement age.

Reason 4: Statistics show that the divorce rate is between 42- 45% ( more in certain countries)

In current times, it is definite that four out of ten marriages end up in divorce. Hence, women need to be smart with money because they do not know what life will hold for them post several years of marriage. If you are not sure of your relationship, taking charge of your own finances becomes imperative. If this means that women need to make amendments to their current work status – then let that be. It is a word of advice to all my women community to start chasing your own income, become a responsible earning member of the family and start learning about your own finances because however much we women want to avoid, these issues are quite recurrent and can happen with any of us at any point of life.

The above are the primary reasons for women to start taking charge of their future financial health.

For the men who are reading this article, for you I have just one piece of advice – Have you ever considered the thought of your wife not being there with you tomorrow? What if she becomes terminally ill? How many of you have taken a good cover for her life insurance and critical illness?

I have heard many men say that they haven’t done life insurance for their wives because their wives are not earning members. But have the men ever thought how much more money they would need to run the family and their kids in the absence of their wives? The cost of getting a full-time maid to take care of the house, a driver to pick and drop the kids to school, a tutor to take care of the child’s studies are just some of the added costs which come to my mind. I am sure this is only a fraction of the total money that will be spent on bringing up the kids alone. Therefore, Dear men – please revisit your insurance plans. Please check if you and your wife are covered well.

Get in touch with your financial advisor before it’s too late.

Written by-

Monika Prasad – Corporate Communications Consultant in Dubai.

Email – [email protected]

Phone number – 0508863923